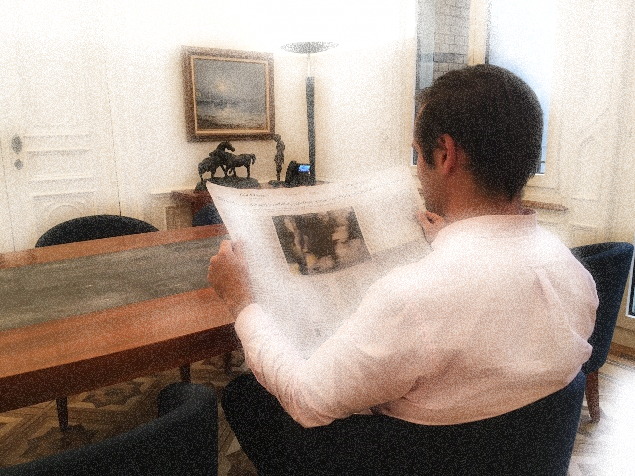

It feels like the world is in chaos, yet it continues to move forward. It is clear that the market is becoming more broadly supported at the sector level, making balanced sector allocation a sensible strategy. Additionally, falling interest rates are currently supporting all asset classes. Regarding the US elections, we see a potential Trump…

Read MoreThe Prio Partners Investment Commentary is published every 6-8 weeks. With independent analyses and straightforward language, the Investment Commentary is intended to encourage reflection on current events and to think outside the box.

IC No. 37 – Balancing Act

Investors have to balance between the obvious current challenges and the otherwise quite positive growth prospects.

Read MoreIC No. 36 – The Market Riddle

The completion of the first quarter of 2024 marks the end of a strong quarter on the stock markets. The MSCI World Total Return gained +8.9% (in USD), the DAX +10.4% (in EUR) and the SMI +5.3% (in CHF). But how can that be?

Read MoreIC No. 35 – Outlook of the Outlooks

Every year, we summarise the annual outlooks of selected financial institutions and give our clients and partners what they can’t buy: Time. In our IC No. 35 – “Outlook of the outlooks 2024”, the topics shown graphically according to frequency and importance indicate the market consensus.

Read MoreIC No. 34 – Tactical Portfolio Management

Throughout history, humans have sought to predict the future to ensure planning security and efficient resource allocation. While forecasting is effective in certain domains like weather, its accuracy declines over longer timeframes. Predicting financial market conditions with high precision is an ideal goal, but it’s important to acknowledge that such accuracy remains elusive.

Read MoreIC No. 33 – The noise of the trees

One of the advantages of capital markets is that investors can participate in the world’s best companies with the click of a button. However, with a wide range of options comes the dilemma of choice. Where does it make sense to invest, and where should one refrain?

Read MoreIC No. 32 – Déjà-vu?

The sale of Credit Suisse to UBS by emergency law on Sunday, March 19, 2023, marks the end of the 166-year history of Switzerland’s second-largest bank.

Read MoreIC No. 31 – Outlook of the outlooks

In the last outlook for 2022, some developments tended to be estimated correctly, but the risks were underestimated. This picture looks different for the 2023 outlook. Our summary of the top 10 topics from a diverse mix of banks and asset managers shows a much more cautious approach.

Read MoreIC No. 30 – Wrap up warmly

In Europe, we have to wrap up warmly in many respects. Not only in terms of energy bottlenecks, but also with regard to bad corporate news and longer-term consequences.

Read MoreIC No. 29 – Don’t fight the FED

We have never boxed before, but we do understand a few simple basic rules: if possible, do not box against stronger opponents. Pace yourself. Keep your guard up in difficult phases. Keep moving and don’t let yourself be pushed into a corner.

Read More